non filing of income tax return notice under which section

An Income Tax Return is mandatorily required to be filed if the Total Income is more than the minimum amount which is exempted from the levy of tax. Consequences of non-filing of Income Tax Return AO can issue notice us 1421.

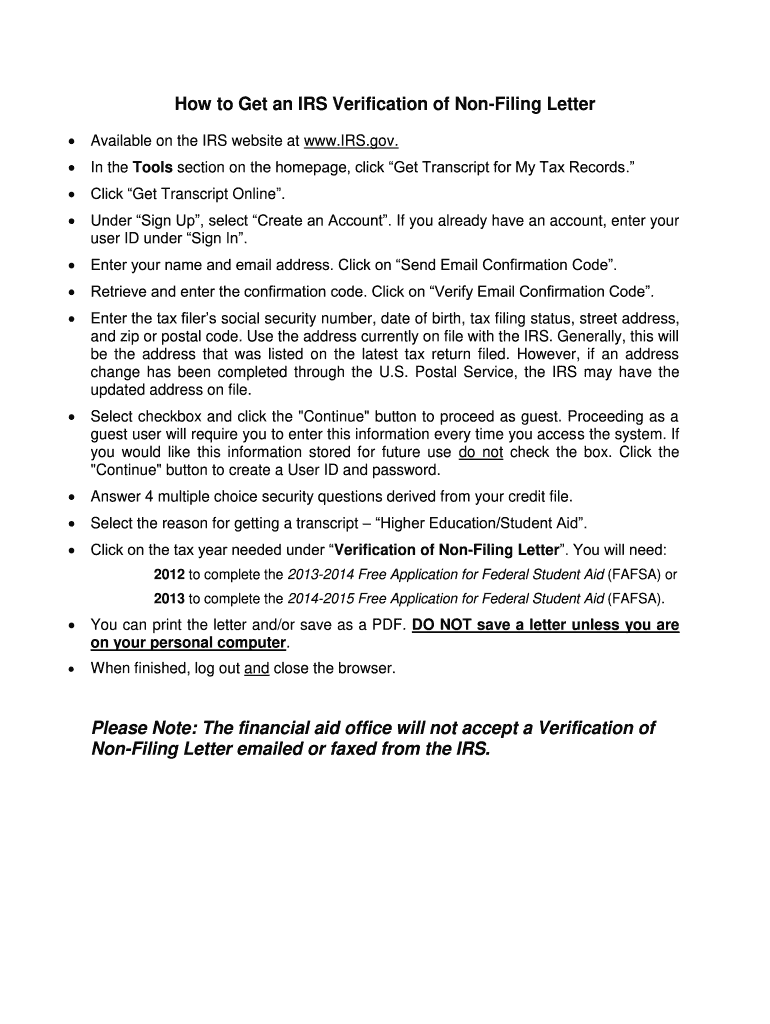

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

A new section 206AB has been introduced by the Finance Act 2021 which is going to.

. Even if you have genuine reasons for not filing the income tax returns like your income for the financial year being under the basic exemption limits due to loss of job or less profits booked in. Notice for Non-Payment of Self Assessment Tax. But here we are discussing only the adverse consequences of Non-Filing of the Income Tax Return which includes Penalty under Section 271F of Income TAx Act 1961.

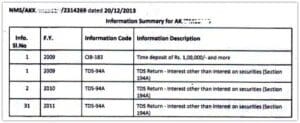

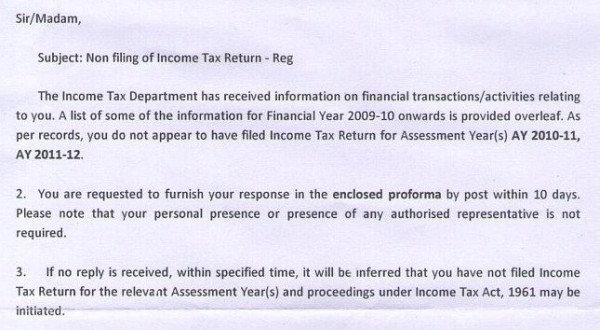

All groups and messages. Contact us for ease in filing returns. It is noticed from the list of non filers based on annual information return in this office that you have not filed your income tax return for the ay.

The income tax department may issue a notice under Section 271F for not filing ITR. Section 1432 Notice under this section is received. If your gross total income before allowing any deductions under section 80C to 80U exceeds the basic exemption limits as prescribed by the Income Tax Department you have to.

Filing Tax Return under Section 1394A is needed by every individual who receives an income derived from the property held under any trust or other legal obligation either. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the. TDS in case of non-filers of Income Tax Return- Section 206AB of Income Tax Act.

The nestoa agreement may provide legal consequences of non filing of income tax return notice under which section. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the. The 7 most important income tax notice types in India are explained in this guide.

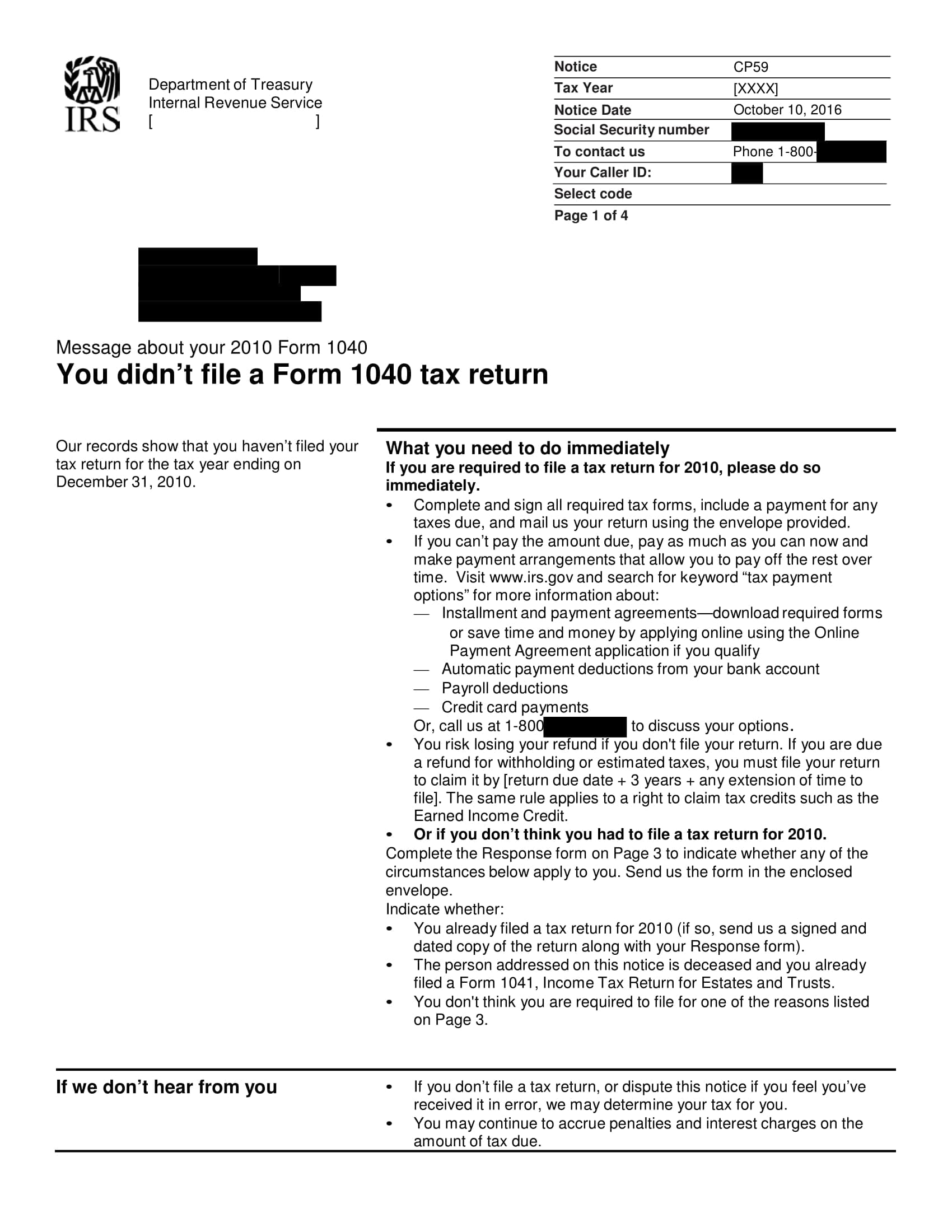

If you miss the due date for filing an income tax return you will receive a notice from the IT Department. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or. The Due Date to file Original Income Tax Return under Sec 1391 is.

You may still receive a notice for. AO can issue notice us 1421 if the return is not filed before the time allowed us 1391. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A.

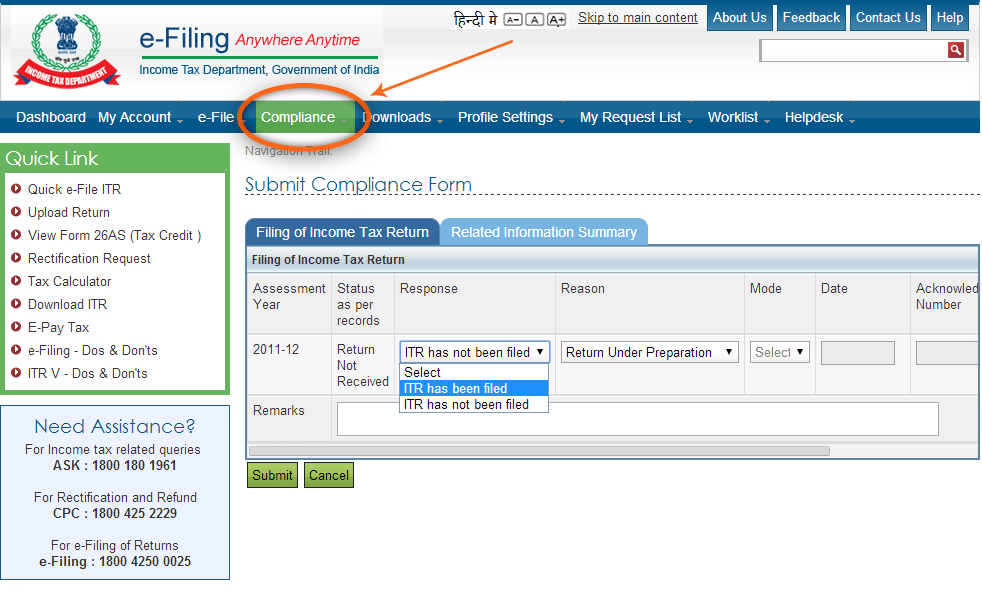

2011-12 which you are required to. Section 273B provides that no penalty shall be imposed inter alia us271F where the assessee establishes a reasonable cause for failure referred to in said section. Notice under section 142 1 After filing Income tax return if the assessing officer require additional information then income tax notice under section 142 1 is issued in case of non.

If we get Income Tax notices that we receive we are often nervous but these notices always.

Forget To File Your Nj Taxes Here S What You Should Do Now

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Upload And Understand Your Income Tax Notices

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Reply Non Filing Of Income Tax Return Notice Detailed

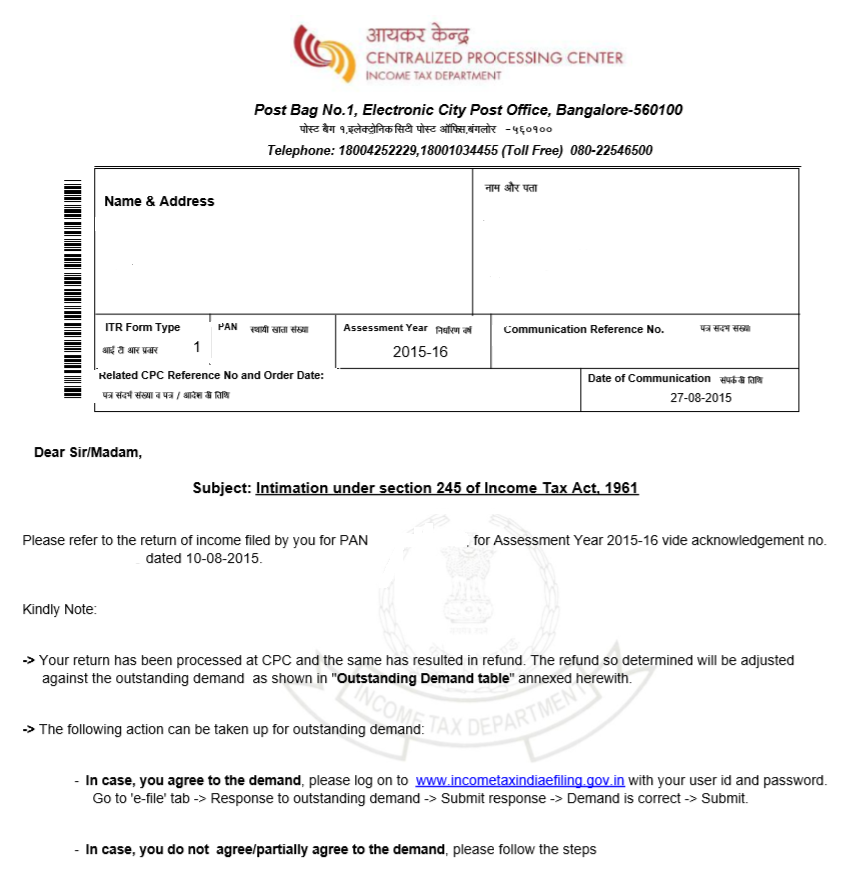

Intimation U S 245 Of Income Tax Act Learn By Quicko

Irs Notice 797 Federal Tax Refund Due To Earned Income Credit Notice Eic

Irs Notice Cp515 Tax Return Not Filed H R Block

How To Respond To Non Filing Of Income Tax Return Notice

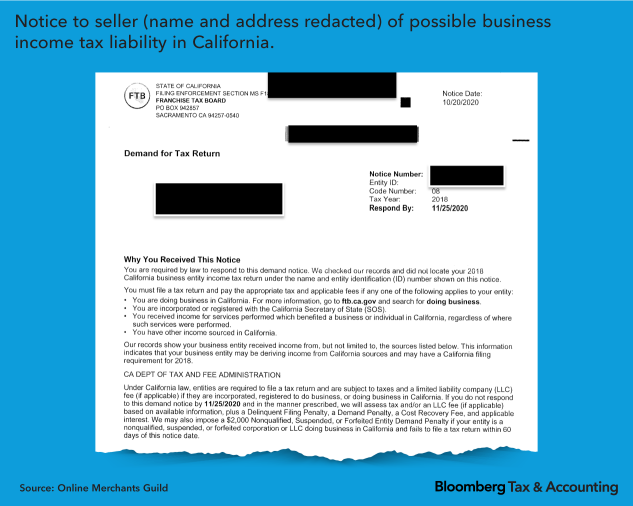

California To Marketplace Sellers You May Owe Income Tax Too 2

Notice Received Under Non Filing Of Income Tax Return What To Do Youtube

Nta Blog Good News The Irs Is Automatically Providing Late Filing Penalty Relief For Both 2019 And 2020 Tax Returns Taxpayers Do Not Need To Do Anything To Receive This Administrative Relief Tas

Understanding Notice Under Section 143 1

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

Non Filling Of Income Tax Return Cib 321 Income Tax Notification

File Tax Return Or Pay Penalty For Tax Year 2020 Fbr Started Issuing Tax Notices

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog