rank real estate asset classes by risk

Realty Income Forbes Bio. In the first half of 2022 investments in real estate grew by 4 per cent Y-o-Y year-on-year to USD 34 billion.

Ubs These 12 Massive Housing Markets Are Too Hot Global Real Estate Marketing World Cities

While the impact of liquidity issues was felt across all asset classes the residential real estate segment was the hardest hit.

. If you are prepared to hold an investment property over a number of years it is bound to rise in value. In 1995 Steve was Vice President and Senior Asset Manager for Cornerstone Real Estate Advisers now Barings Inc a wholly-owned subsidiary of MassMutual Financial Group where he was responsible for over 13 million square feet of commercial property in the Southeastern US. Stocks just had its worst first half of the year going back over 50 years.

You can insure for many of the risks. New York New York. Is a real estate company which engages in generating dependable monthly cash dividends from a consistent and predictable level of cash flow from operations.

Magazine said more Real Estate Investment Trusts REITs would get listed on the stock exchanges to monetise rent-yielding office retail and warehousing assets. Headquartered in Pasadena Alexandria Real Estate Equities ARE is a Finance stock that has seen a price change of -2876 so far this year. History has proved that real estate is possibly the most forgiving asset over time.

Not just building insurance but smart investors take out landlords insurance to protect their interests. It also involves in in-house. The index fell 206 in the past six months from its high-water mark in early.

Primary Asset Type. To mitigate this impediment in November 2019 the central government announced a 25000-crore special window to help complete over 1500 stressed housing projects comprising around 458000 housing units. The SP 500 Index a barometer of US.

Currently paying a dividend of 118 per share the. Valued in excess of 110 million.

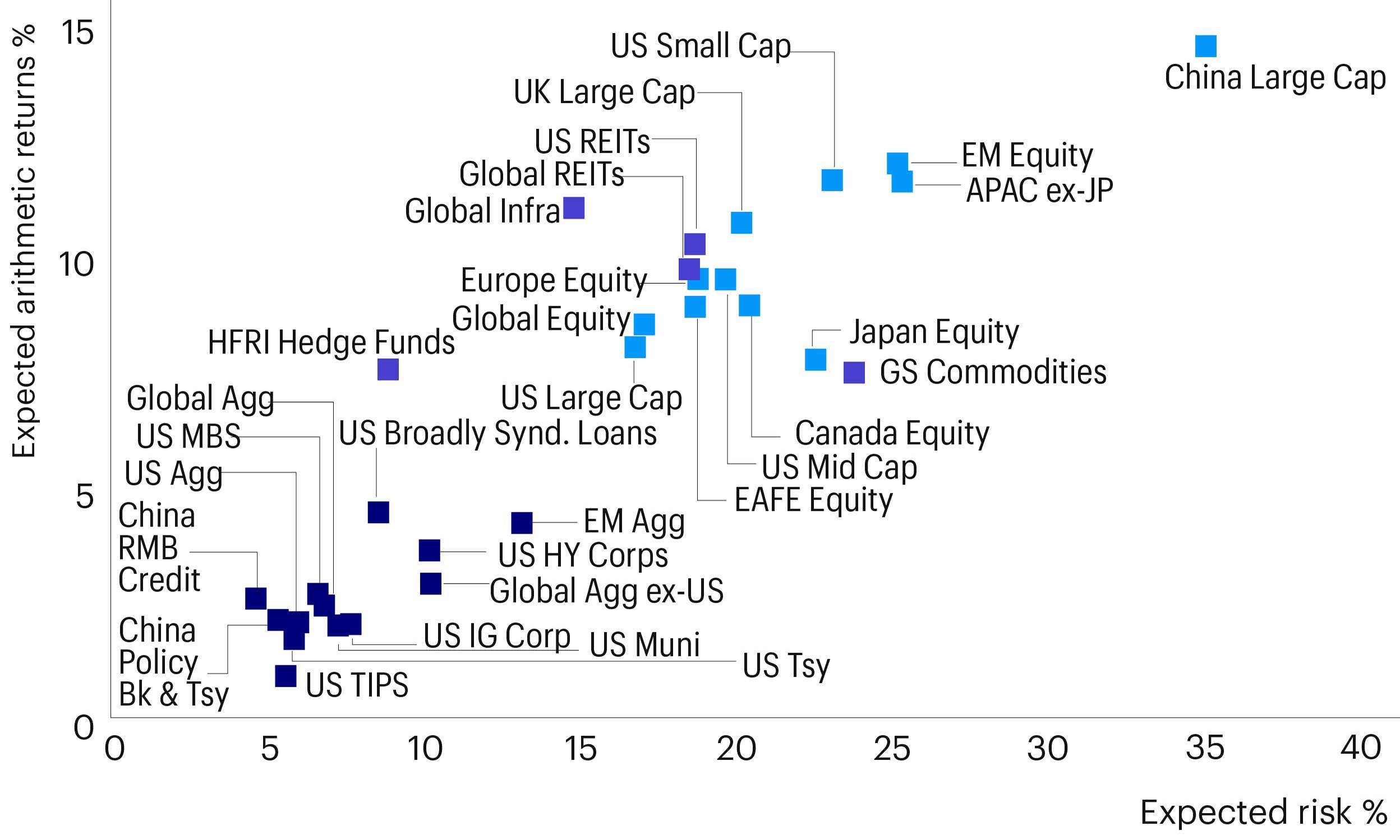

2022 Long Term Capital Market Assumptions

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Asset Allocation Planning Your Asset Allocation Between Large Cap Mid Cap Small Cap And Other Asset Clas Small Caps Stock Market Investing Small Cap Stocks

What Is My Investment Risk Tolerance Peerfinance101 Investing Finance Investing Money Management Advice

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Important Two Things You Must Consider Before Deciding On A Category Age Risk Appetite In General You Should Be More Risk Averse As You Have Time

How To Achieve Optimal Asset Allocation Investing Personal Financial Planning Investment In India

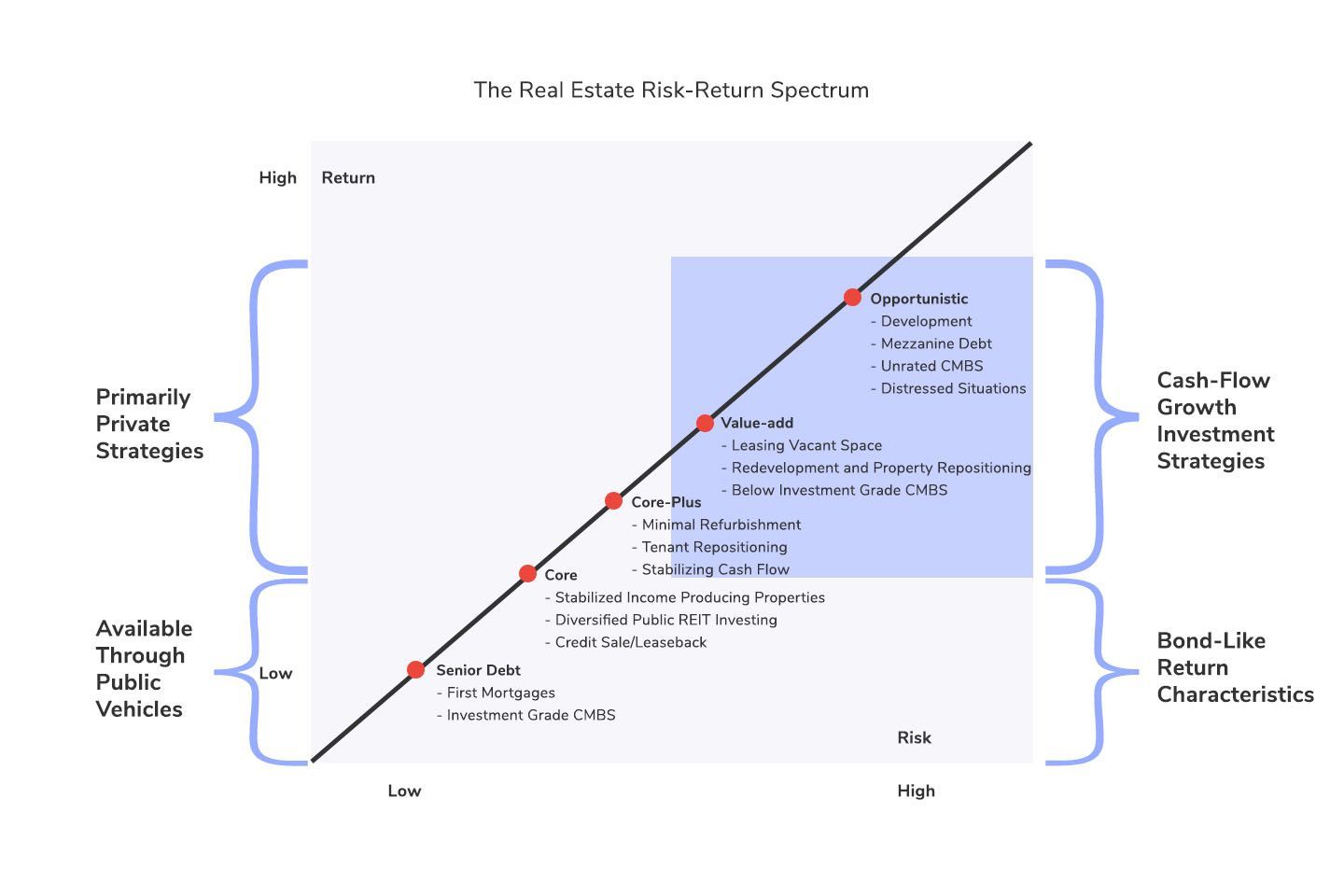

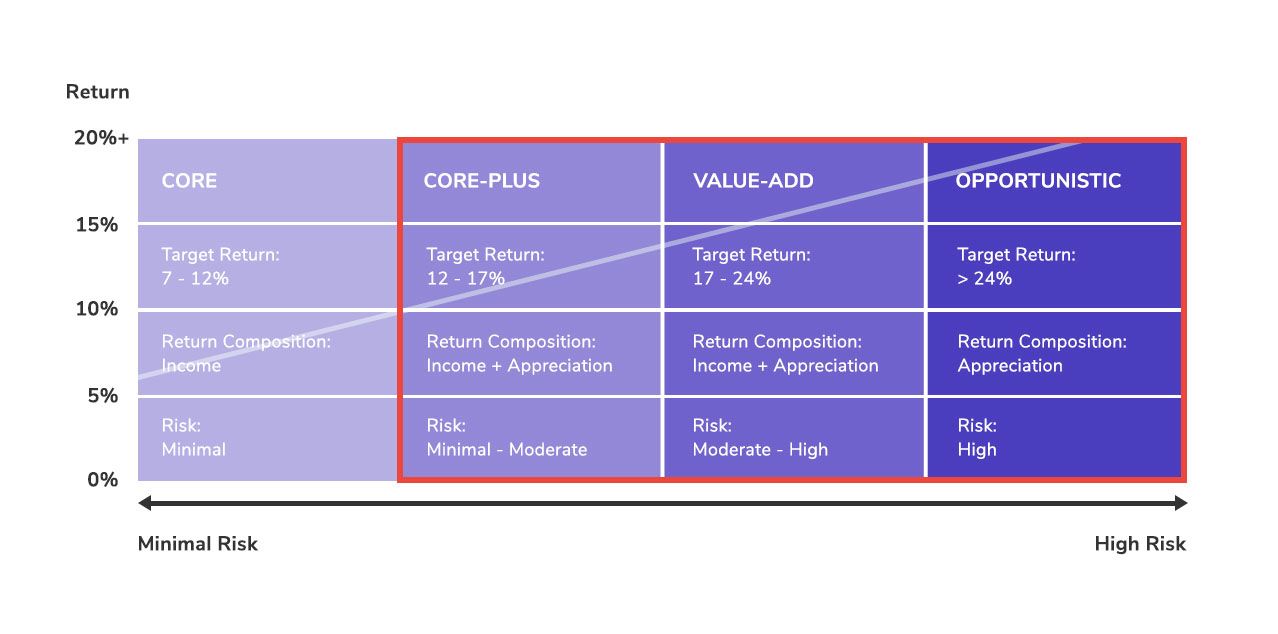

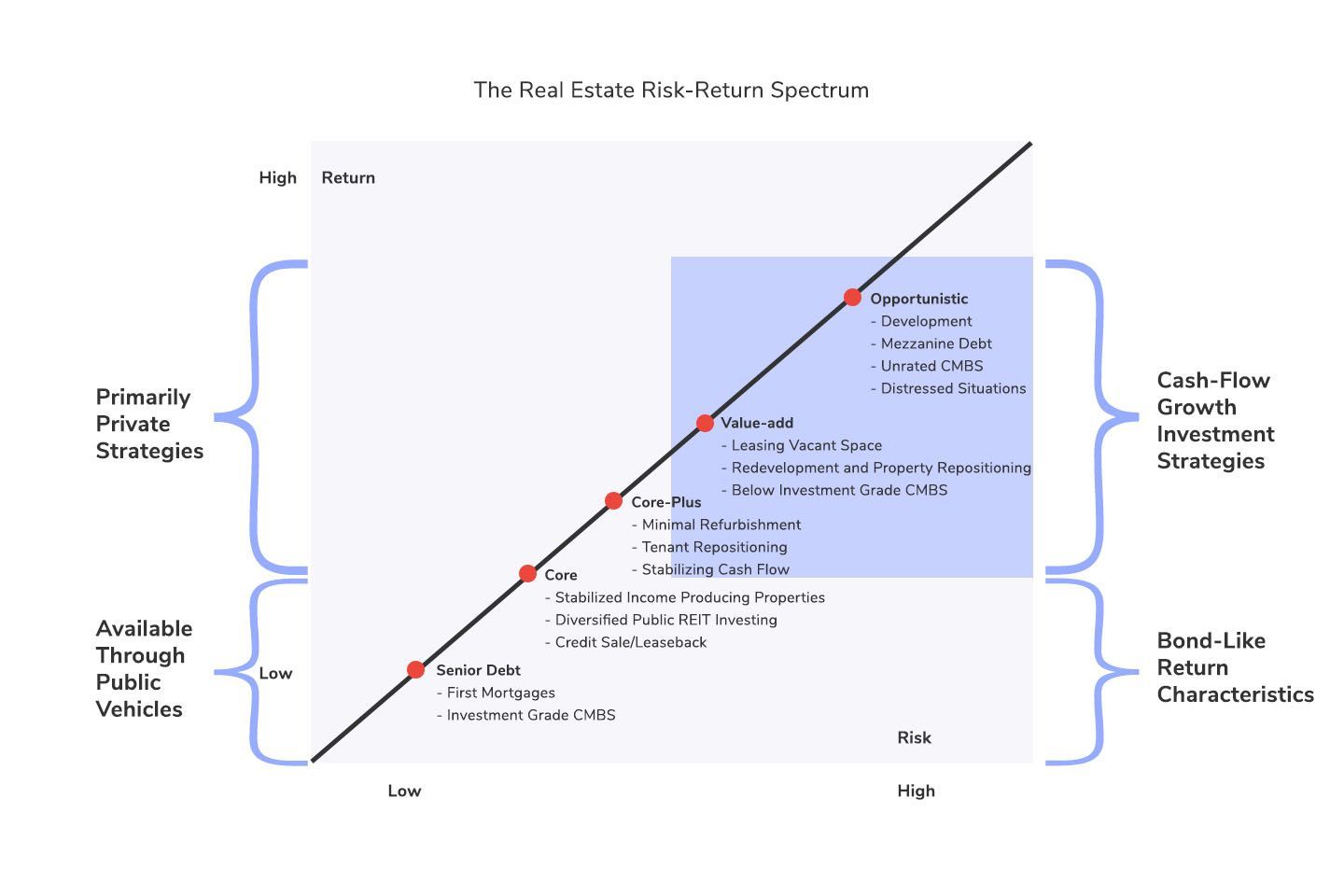

The Real Estate Risk Reward Spectrum Investment Strategies

The Real Estate Risk Reward Spectrum Investment Strategies

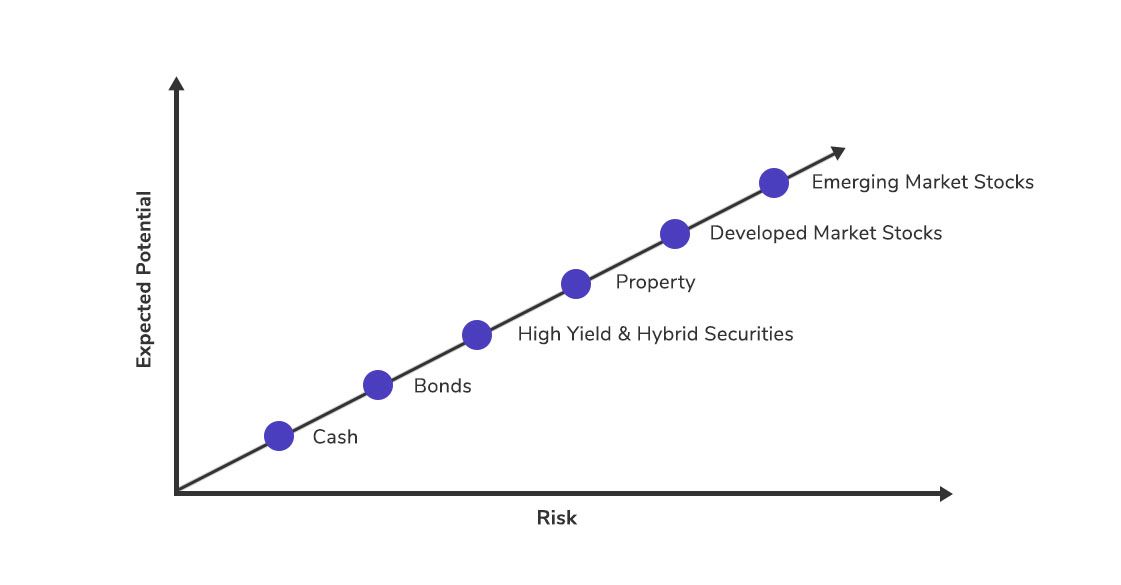

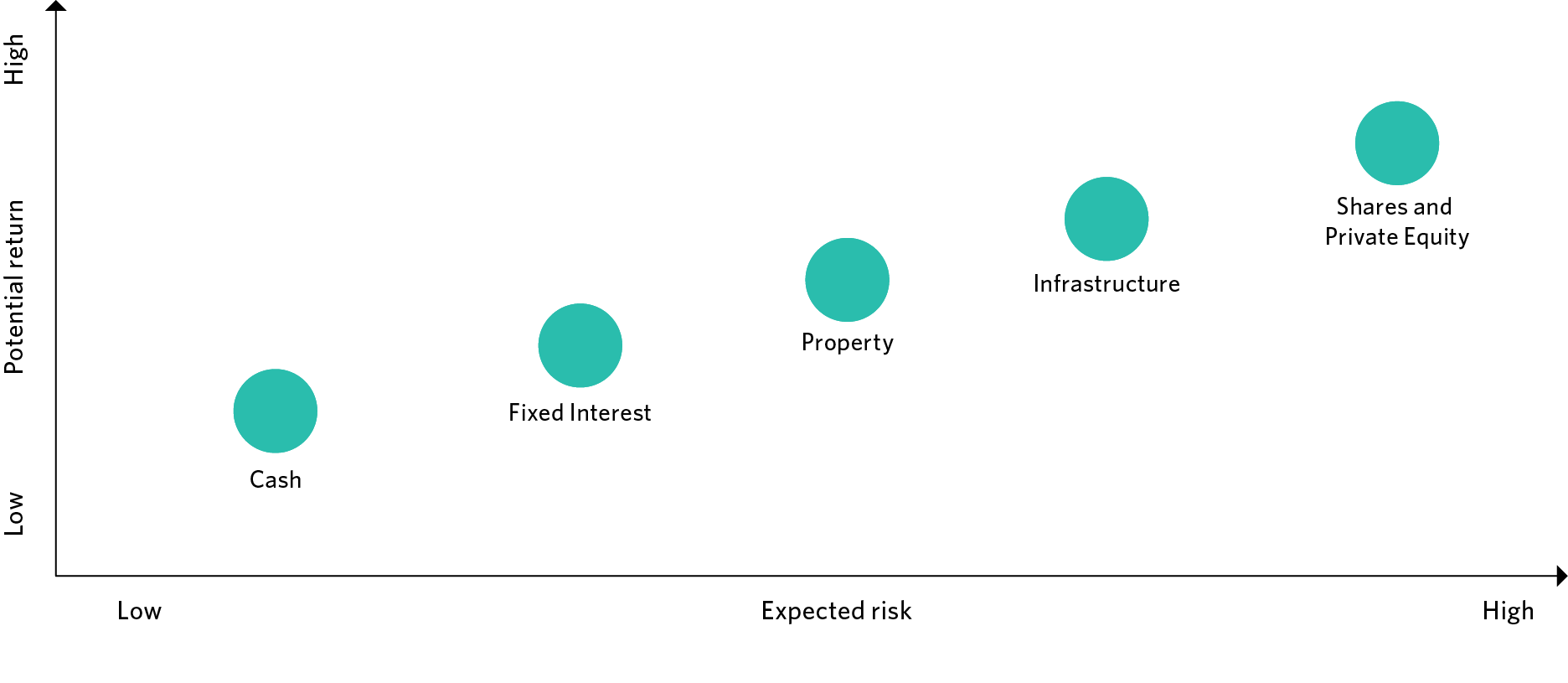

Asset Classes Explained Understanding Investments Unisuper

Team Genus Asset Allocation Financial Literacy Lessons Forex Trading Quotes Finance Investing

The Real Estate Risk Reward Spectrum Investment Strategies

Internet Browser Market Share 1996 2019

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

The Proper Asset Allocation Of Stocks And Bonds By Age

Help Wanted Venture Capital Growth Company Help Wanted

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)