real property taxes las vegas nv

Get a Full Report. REAL ESTATE LISTINGS HELD BY BROKERAGE FIRMS OTHER THAN THIS.

What S The Property Tax Outlook In Las Vegas Mansion Global

What taxes do Nevada residents pay.

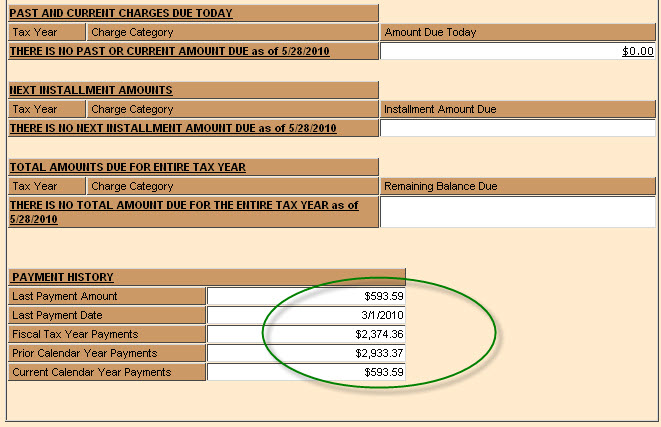

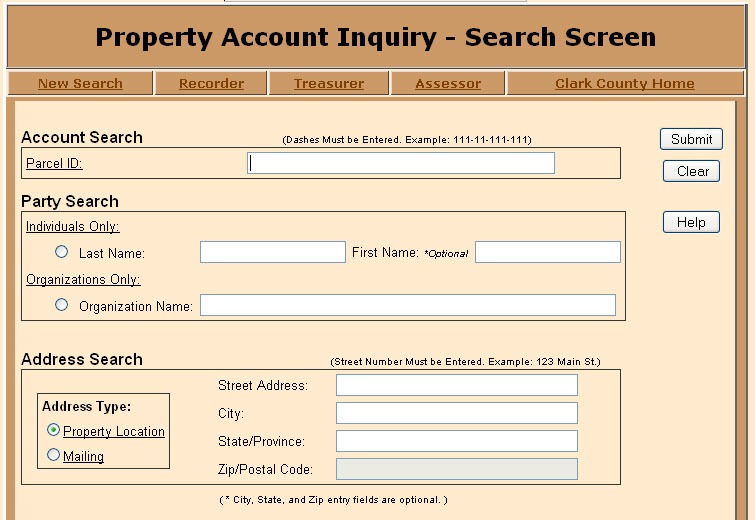

. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax. Compared to the 107 national average that rate is quite low. This public search page can be used to determine current property taxes.

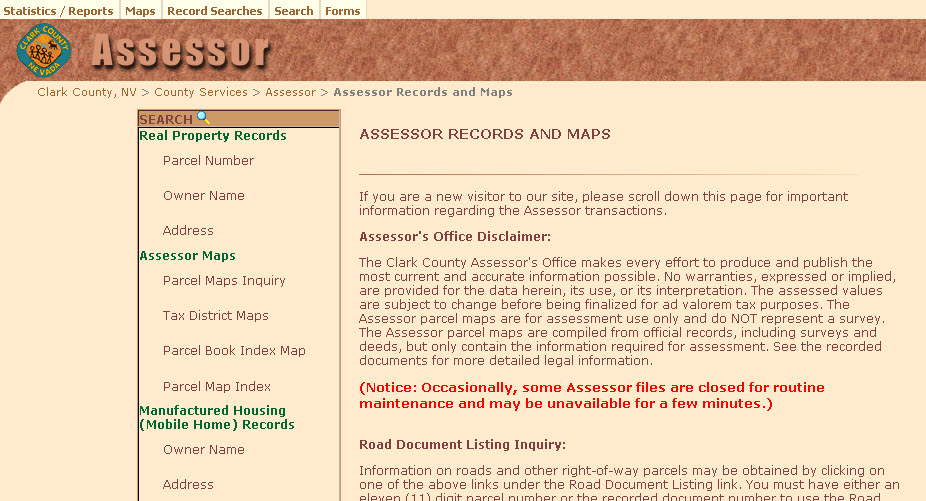

Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more. 051 effective real estate tax rate. 2Reviews applications for exemption and determines whether the transaction.

Make Real Property Tax Payments. 056 effective real estate tax rate. Clark County Detention Center Inmate Accounts.

You Can Learn the Current Owners Name and Even the Propertys Past Owners. The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Las Vegas NV 89155-1220.

As a general rule of thumb annual estimated property taxes can be calculated at roughly 5-75 of the purchase price. The State of Nevada sales tax rate is 46 added to. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

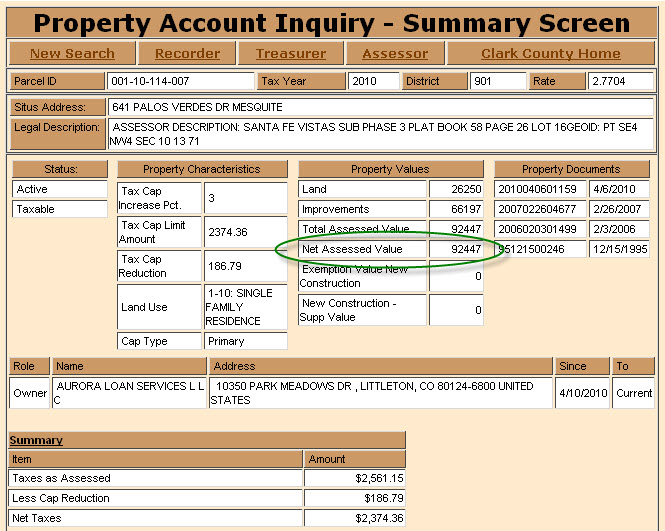

Don C Send an email February 14 2022. The states average effective property tax rate is just 053. The assessed value is equal to 35 of the taxable value.

Our Rule of Thumb for Las Vegas sales tax is 875. Next find the assessed value which is thirty-five percent of 6428000 or 2249800. Technically the Las Vegas sales tax rate is between 8375 and 875.

The figure you are left with is your capital gain on the property and based on your non-property income you will have to pay up to 30 in federal and state taxes on your capital. North Las Vegas NV 89030. To ensure timely and accurate posting please write your parcel numbers on the check and.

0 67 2 minutes read. Counties in Nevada collect an average of 084 of a propertys assesed fair. Real Property Services assists City.

Townhome located at Las Vegas NV 89122 on sale now for 295000. Account Search Dashes Must be Entered. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

111-11-111-111 Address Search Street Number Must be Entered. Homeowners in Nevada are protected from steep increases in. In Las Vegas NV the estimated annual property taxes can be calculated at roughly 5 to 75 of the.

Skip to main content. The property tax rates in Nevada are some of the lowest in the nation. Tax bills requested through the automated system are sent to the mailing address on record.

NRS 3614723 provides a partial abatement of taxes. 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. Las Vegas NV 89106.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. View 21 photos of this 3 bed 3 bath 1468 sqft. Please verify your mailing address is correct prior to requesting a bill.

Multiply the assessed value by the tax rate which is 32782 in Las Vegas City in. COUNTRY LANE EST UNIT 1 PLAT BOOK 36 PAGE 59 LOT 22 BLOCK 3. LAS VEGAS NV 89131-3224.

Ad Discover Owner Information Registered Liens Property Taxes More. Payment Options for Real Property Taxes only Mail. While tourists come to Nevada to gamble and experience Las Vegas residents pay no personal income tax and the state offers no corporate tax no.

Real PropertyVehicle Tax Exemptions Nevada Wartime Veterans Tax Exemption applies to residents who have served in the Armed Forces of the United States in any of the following. Facebook Twitter Instagram Youtube NextDoor. Assessor - Personal Property Taxes.

If youre thinking about buying a home in Las. PROGRAM OF THE GREATER LAS VEGAS ASSOCIATION OR REALTORS MLS. Property Account Inquiry - Search Screen.

123 Main St. Las Vegas Nevada 89155-1220. Business Life Style Real Estate Property Taxes in Las Vegas 2022.

Real Property Assessed Value Fiscal Year 2021-22. 055 effective real estate tax rate. Please visit this page for more information.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Checks for real property tax payments should be made payable to Clark County Treasurer. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be.

Mesquitegroup Com Nevada Property Tax

Las Vegas Area Clark County Nevada Property Tax Information

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Top 10 Reasons To You Should Move To Las Vegas Nv

Mesquitegroup Com Nevada Property Tax

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Property Taxes Are Not Uniform And Equal In Nevada The Nevada Independent

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Where People Pay Lowest Highest Property Taxes Lendingtree

Mesquitegroup Com Nevada Property Tax

Property Taxes Are Not Uniform And Equal In Nevada The Nevada Independent

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Free Nevada Real Estate Purchase Agreement Template Pdf Word